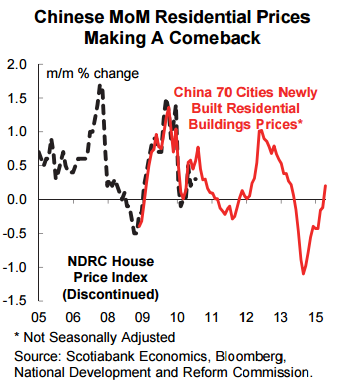

Chinese property is generating a little more interest lately. After over a year of housing market weakness, a series of property market indicators have appeared to stabilize: floor space sold, total sales of buildings, and completed investment in residential real estate all appear to have rebounded over the past two to three months. On Sunday evening, China's June property prices will be released and, while the y/y growth trend will still be negative, all leading indicators point to a second month of m/m gains.

A stabilization in property markets, or even a rebound, will carry significant growth implications for China, with knock-on effects to global markets and, while the recent data could turn out to be a false start, the trend change is worth monitoring very closely. That's particularly true in the context of a less attractive stock market: investment flows may find property to be relatively more attractive at this juncture and, the positive wealth effect from a property market bounce would likely far outweigh any negative stock market wealth effect.

The June reading of China's private purchasing managers' index for the manufacturing sector (PMI) is due out Thursday and will probably continue to float just below or just above the key 50 level. A PMI around 50 broadly implies manufacturing activity is neither accelerating nor decelerating over the month but is instead fairly stable in a no-growth zone. Note that the private PMI has a new sponsor beginning this month and so will carry a different headline, but the private methodology will be unchanged.

Chinese Property Markets On The Upswing?

Thursday, July 16, 2015 9:48 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX