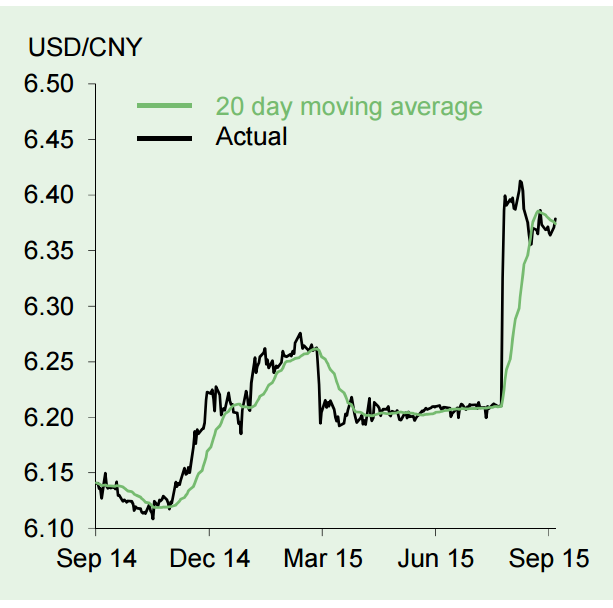

The CNY has retraced from its August post devaluation of 6.44 against the USD. PBoC intervention and efforts to curb speculation against the CNY have helped to stabilise the exchange rate within a tight range of 6.3354-6.383 in September. Policy makers in China have signalled that they favour exchange rate stability after the one- off change in August to their daily fixing methodology. - a change that opened the door to greater market influence in the CNY.

The short-term desire for stability may mean delays to further liberalisation in China's capital account that would have allowed for greater outflow, and potentially add greater volatility in the exchange rate. Heavy intervention by the PBoC, however, is unlikely to last indefinitely. Looser monetary policy and clear signs of a slowdown in underlying activity favour a weaker CNY.

"We expect the PBoC to allow for gradual depreciation in the exchange rate once the veil of uncertainty around the timing of the first rise in US interest rates is lifted", notes Lloyds Bank.

Chinese Yuan review

Thursday, September 24, 2015 12:42 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022