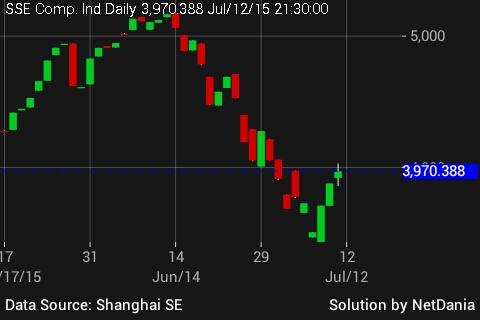

China's securities regulator has moved to take some sensible steps, while country's stock market continued recovery for third consecutive day after dropping as much as 30% from June peak.

During the stock boom of 2014/15, in which China's benchmark stock index Shanghai composite rose more than 150%, margin lending rose sharply and reached as high as $365 billion. However Chinese authorities chose to look the other way, when analysts and economists across the world were warning on the dangers of such high margin lending.

As of now it is not clear whether the stock market has reversed its uptrend or not but Chinese authorities had to throw in a lot to halt the drop, which within a month wiped out more than $3 trillion worth of valuation.

Latest move from Chinese securities regulator show, that Chinese authorities might finally have taken some lessons from the recent panic.

The regulator has taken steps to curb margin lending in the grey market, warned brokerages on Sunday night to stop opening their trading systems to lightly regulated "fund-matching" companies that distribute loans for leveraged stock bets.

According to sources at peak Grey market margin lending accounted for close 50% of the margin lending or $160 billion.

Today 450 companies resumed trading after as much as 50% of the stock or banned for trading. However real test will be when all of them (remaining 36%) resume trading.

Shanghai composite is up 2.7% for the day, closed at 3970.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings