Dollar is weak over the board as Chinese stock market closed its second largest slide in more than a decade.

Why Chinese rout is bad for dollar?

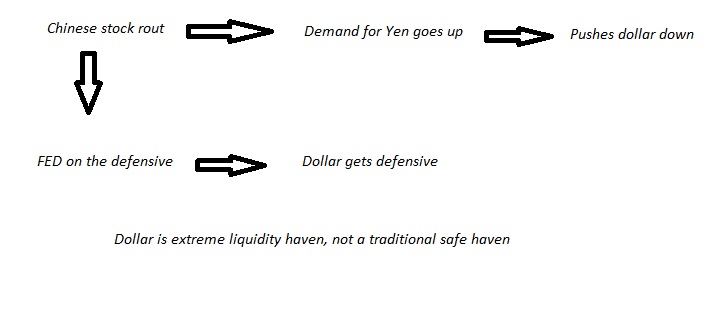

Dollar acts as a safe haven but an extreme one, it can be called as liquidity haven. Dollar is the king, when a situation like 2008/09 occurs as investors panic and run to safety of liquidity. Which as of now doesn't seem to be the case in China.

Instead a selloffs in China and stock market around the world is likely to push investors to safety of Yen (another safe haven).

Yen is up more than a quarter percentage points against dollar so far today, trading at 123.3. This is likely to put dollar on back foot.

Moreover FED Chair Janet Yellen expressed her concern over two international developments, Greece and Chinese stock crash.

A massive rout in China is likely to put FED in defensive position over rate hike (though one hike is expected any way). So hedge funds and investors, who are extremely hawkish and predicting two rate hike over the next eight months are likely to retreat and pushing the dollar down.

Dollar has taken broad based hit today, with FXCM dollar index is down 0.25% for the day so far.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary