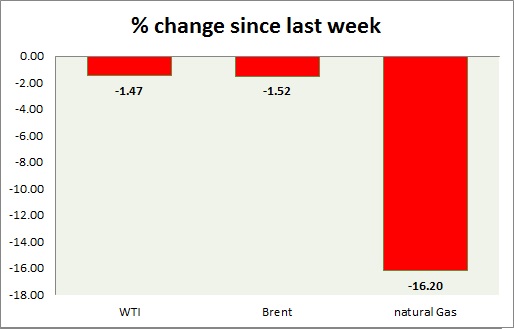

Energy pack is mixed in today’s trading. Weekly performance at a glance in chart & table,

Oil (WTI) –

- Oil price remains elevated over geopolitical tensions surrounding Iran and Venezuela and as inventories slide. Today’s range - $64.6-$65.5

- WTI is currently trading at $65.2/barrel. Immediate support lies at $62 area and resistance at $66 area.

Oil (Brent) –

- Brent remains elevated over WTI due to higher demand, geopolitical tension and OPEC agreement. Today’s range - $68.8-69.7

- Brent is trading at $4.2 per barrel premium to WTI.

- Brent is trading at $69.4/barrel. Immediate support lies at $67 area and resistance at $72 region.

Natural Gas –

- Natural gas declining sharply after major spike as winter end nears and as contract shifted. Expect elevated volatility. Today’s range $2.92-2.98

- Natural Gas is currently trading at $2.93/MMBtu. Immediate support lies at $2.82, $3.01 area & resistance at and $3.21 and at $3.35

|

WTI |

-1.47% |

|

Brent |

-1.52% |

|

Natural Gas |

-16.2% |

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed