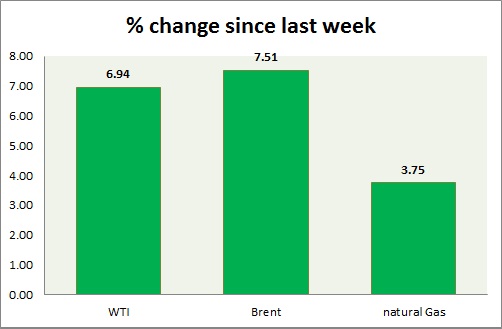

Energy performance is mixed in today's trading. Weekly performance at a glance in chart & table -

- Oil (WTI) - WTI selloffs continued as expected after key support level got broken. WTI has reached initial target of $42.5/ barrel. Today is sixth consecutive decline. WTI is currently trading at $43/ barrel, down nearly 2% today. Immediate support lies at 42 and resistance at 48.3.

- Oil (Brent) - Brent continued fall as concerns rise over new exports from Iran. Brent-WTI spread is trading at $ 9.6, support lies at $8 and resistance at $13. Brent has reached the initial target of $53. Price continued fall due to momentum but might remain capped as FOMC looms ahead. Brent is trading at $52.64/barrel. Immediate support lies at 53.2 & resistance at 58.4.

- Natural Gas - Natural gas bounced from support as prospect of an inventory crunch rose. Companies installing more natural gas capacity to generate electricity is leading to the crunch with addition of colder temperature. Last week inventory fell below 5 year average. Natural Gas is currently trading at 2.79/mmbtu. Price range is squeezing, there might be breakout ahead. Immediate support lies at 2.65 & resistance at 2.87.

|

WTI |

-4.25% |

|

Brent |

-2.99% |

|

Natural Gas |

3.31% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings