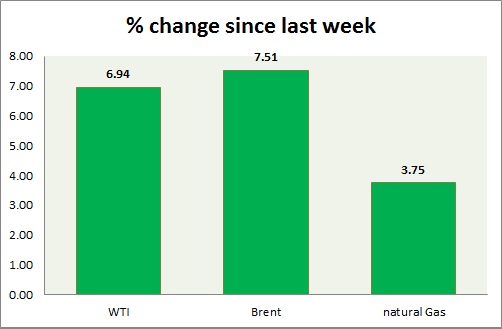

Energy is showing some signs of life amid weaker dollar. Weekly performance at a glance in chart & table

- Oil (WTI) - WTI is continuing its post FOMC rally. Weaker dollar continues to improve appeal of US crude amid oversupply. Today's inventory report showed another solid gain in inventory of 8.17 million barrels much higher than expected 5.13 million barrels. However gain is little lower than previous 9.62 million barrels. WTI has shrugged off the inventory report. It is currently trading at 48.1, up 1.33% today. Price target is coming around $51/barrel and $54/barrel. Immediate support lies at 42, 38 and resistance at 48.3, 53.

- Oil (Brent) - Possibilities of Iranian supply is weighing on Brent. Brent-WTI spread tightened, trading at $ 7.2/barrel, might go further down as it broken the support at $8/barrel. Last week it traded close to $11.5/barrel. Brent is trading at $55.5/barrel, up 0.35% today. Immediate support lies at 52.5, 48, 45 & resistance at 58.4, 62.

- Natural Gas - Natural gas is the worst performer today and this week however still trading within its range. Approaching summer is weighing on price. Natural Gas is currently trading at 2.73/mmbtu, down -1.80% today. Immediate support lies at 2.65, 2.55 & resistance at 2.91, 3.02.

|

WTI |

3.29% |

|

Brent |

0.43% |

|

Natural Gas |

-1.94% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary