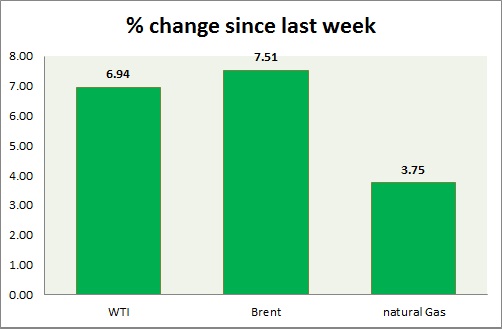

Energy is rising sharply today, as tensions rise in Middle East. Weekly performance at a glance in chart & table

Oil (WTI) -

- WTI is up 4% today, as tensions in Middle East escalating.

- Bulls are struggling after reaching first bullish target of $51 last week.

- Target to the downside around $45. Bias is downwards, however higher volatility will remain concern.

- Today's EIA report showed, inventory rose by another 4.78 million barrels, however lower than previous 8.17 million barrels.

- WTI is currently trading at $49.4/barrel. Immediate support lies at 47.5-47, 44-43.7 and resistance at 51.7-52.1, 54-54.5, 58.7-59.2. $50 might pose some resistance.

Oil (Brent) -

- Brent gained sharply as Iran and world powers yet to agree on proposals.

- Brent-WTI spread gained after shrinkage since last week, trading at $ 7.4/barrel, however still remains on weaker side and might shrink further.

- Brent is trading at $56.9/barrel, up 3.3% today. Bias is still downwards. Immediate support lies at 53 & resistance at 59.6-60.

Natural Gas -

- Natural gas weakened further after it broke key support this week. Price is moving to challenge next level.

- Price pattern suggests that prices might drop down towards $2.44/mmbtu.

- Approaching summer is weighing on price.

- Natural Gas is currently trading at 2.59/mmbtu, down 1.9% today. Immediate support lies at 2.55 & resistance at 2.66, 2.74.

|

WTI |

+2.26% |

|

Brent |

+1.52% |

|

Natural Gas |

-2.34% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?