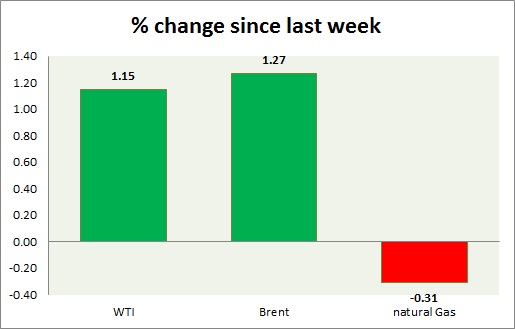

Energy pack is mixed in today’s trading. Weekly performance at a glance in chart & table.

Oil (WTI) –

- WTI is racing higher as it cleared crucial resistance around $52 area on Syria airstrikes. Today’s range $52.3-53

- WTI is currently trading at $52.8/barrel. Immediate support lies at $49 area and resistance at $54 area.

Oil (Brent) –

- Brent is up in line with the WTI. Brent is testing key resistance. Today’s range - $55.2-56

- Brent is trading at $3.1 per barrel premium to WTI. Likely to widen further in the medium term.

- Brent is trading at $55.9/barrel. Immediate support lies at $49 area and resistance at $56 region.

Natural Gas –

- Natural gas suffering a correction from the key resistance around $3.3 area. Today’s range $3.29-3.22

- Resuming long-term bull trend would push gas price to $4.3 per MMBtu.

- Natural Gas is currently trading at $3.24/MMBtu. Immediate support lies at $2.8 area & resistance at and $3.2

|

WTI |

+1.15% |

|

Brent |

+1.27% |

|

Natural Gas |

-0.31% |

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022