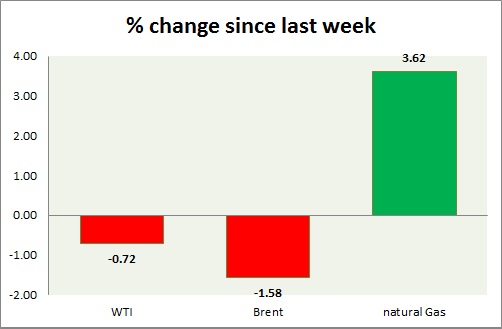

Energy pack is mixed, while oil is down, gas is in green. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI traded in high volatility today as Iran deal sanctions removal weighs on price. WTI traded as low as $51.9/barrel falling from as high as 53.5 as Iran sanctions remain in place.

- $54 area remains crucial resistance. Today's range $53.5-51.9

- Crude stocks shrank by -4.35 million barrels.

- WTI is currently trading at $52.4/barrel. Immediate support lies at $51.2-50 and resistance at $54

Oil (Brent) -

- Possible Iran sanction removal by next week is keeping the pressure on Brent.

- Brent-WTI spread flat today, currently trading at $5.4/barrel.

- Target is reached around $55/barrel, and next target is around $51/barrel.

- Brent is trading at $57.8/barrel. Immediate support lies at $55 area and resistance at $59/60 region.

Natural Gas -

- Natural gas bulls tried to assault $2.95/mmbtu area, however progress was halted at $2.92 area.

- Bulls are in control, however bears still remain strong around the above mentioned level.

- Bullish Doji, in weekly chart remains in focus.

- Natural Gas is currently trading at $2.89/mmbtu. Immediate support lies at $2.55, $2.45 area & resistance at $2.93, $3.04, $3.32.

|

WTI |

-0.72% |

|

Brent |

-1.58% |

|

Natural Gas |

+3.62% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary