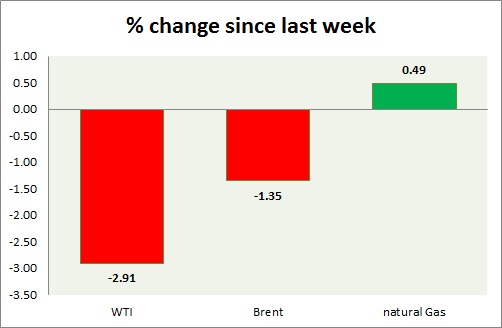

Energy pack is marginally up today. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI has broken key level at $50/barrel. Today's range $49-49.6

- WTI is likely to fall towards $42 area. The drop might extend below $40 area. $45 will serve as interim support.

- EIA report showed crude inventory rose by 2.5 million barrels.

- Sell WTI with stop around $53.5-54/barrel and target of $46 and $41.

- WTI is currently trading at $49.4/barrel. Immediate support lies at $50 and resistance at $54

Oil (Brent) -

- Brent is better performer than WTI, as congress sought to block Iran deal.

- Brent-WTI spread gained by 60 cents since yesterday, currently trading at $7/barrel.

- Next target is around $51/barrel if support around $55/barrel gets cleared.

- Brent is trading at $56.3/barrel. Immediate support lies at $55 area and resistance at $59/60 region.

Natural Gas -

- Natural gas bulls moved above $2.95 for first time in many days, however failed to decisively break bears. Today's range $2.87-2.955.

- EIA reported inventory rise by 69 billion cubic feet.

- A break above $2.95 area would push prices to first target of $3.1/mmbtu. However a failure would push prices lower.

- Natural Gas is currently trading at $2.89/mmbtu. Immediate support lies at $2.55, $2.45 area & resistance at $2.95, $3.04, $3.32.

|

WTI |

-2.91% |

|

Brent |

-1.35% |

|

Natural Gas |

+0.49% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate