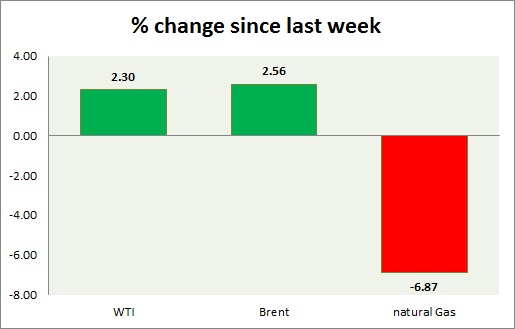

Energy pack is down in today’s trading. Weekly performance at a glance in chart & table,

Oil (WTI) –

- WTI continues to struggle despite optimism over OPEC deal extension later this month as Saudi Arabia’s oil minister announced an agreement with the Russian oil minister on the extension of the deal till March 2018. We expect the WTI to reach $43 per barrel. Target extended to $38 per barrel. Today’s range $48-49.2

- WTI is currently trading at $48.9/barrel. Immediate support lies at $44 area and resistance at $52 area.

Oil (Brent) –

- Brent is up in line with the WTI this week. Brent is likely to drop below $40 per barrel. Today’s range - $51-52.3

- Brent is trading at $3.2 per barrel premium to WTI. Likely to widen further in the medium term.

- Brent is trading at $52.1/barrel. Immediate support lies at $50 area and resistance at $56 region.

Natural Gas –

- Natural gas suffered big selloffs, despite small increases in inventories. The focus will remain on inventory reports. Today’s range $3.18-3.25

- Resuming long-term bull trend would push the gas price to $4.3 per MMBtu.

- Natural Gas is currently trading at $3.18/MMBtu. Immediate support lies at $2.95 area & resistance at and $3.3

|

WTI |

+2.30% |

|

Brent |

+2.56% |

|

Natural Gas |

-6.87% |