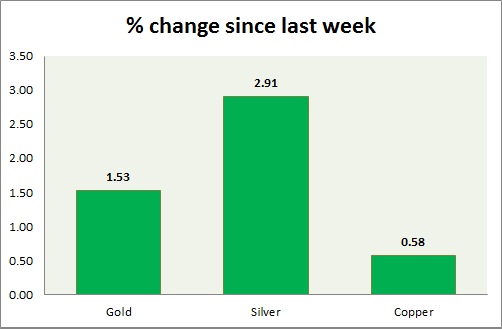

Despite this week's gain precious pack is overall underperforming. Performance this week at a glance in chart & table -

Gold -

- Gold trying to test dollar $1200 area, after finding support around $1178 level.

- This week's NFP report holds key to further price action. Bears are likely to break below should $1209 holds. Bulls need to break above $1224 area to diminish bearish bias.

- Gold is currently trading at $1196/troy ounce. Immediate support lies at $1178, $1160 and resistance at $1209, $1224 and $1236-1240 area.

Silver -

- Silver is flat today, after major bounce yesterday. Still the best performer this week. Silver still remains in bearish control, however bulls have defended key support area.

- Mint ratio is down -0.22%, currently at 72. Mint ratio and precious metal prices are inversely related more often than not.

- Silver is currently trading at $16.6/troy ounce, up 2.9% since last week. Support lies at $15.42, $14 & resistance at $16.3-$16.6, $17.5-17.7.

Copper -

- Copper has made successful advance today as weak dollar continue to provide support to bulls. However $3 area might pose psychological resistance.

- Bulls might be targeting $3.16 area.

- Copper is currently trading at $2.94/pound, immediate support lies at $2.86, $2.76 & resistance at $2.95, $3.07.

|

Gold |

+1.53% |

|

Silver |

+2.91% |

|

Copper |

+0.58% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?