Crude oil rebounded sharply after Federal Reserve issued dovish statement and forecast. However oil arbitrageurs have less to cheer for. Crude is up by almost 15% and six months contango dropped about 30%.

What is physical arbitrage?

- Physical arbitrageurs speculate over calendar spread that is buying the spot and selling the future. These traders buy the physical crude at cheapest rate possible, store it at minimal cost and then sell it at higher rate in future.

Physical arbitrage provides significant revenue for commodity trading firms.

- Glencore, Gunvar, Nobel are the top commodity trading houses utilizing these opportunities.

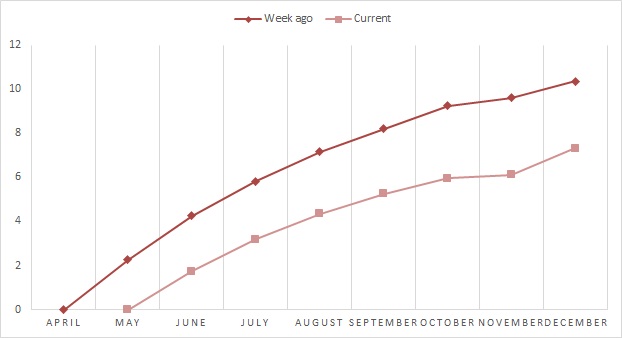

- Six months contango is down from $9.5/barrel to $6.1/ barrel. Minimum $6.5/barrel is required to store oil offshore and make a profit.

- During 2008's super contango six month's arbitrage saw spread rise to $12.29/barrel. Moreover volatility in the contango market will further dissuade traders from taking very long position until the dust settles.

- Oil price drop is fueling the contango this time around as oversupply keeps pressure over spot prices.

Last contango saw floatation of oil over sea as much as 40 million barrels and price went as high as $140/barrel. This time around, it has so far remained less lucrative.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings