WTI crude oil is down 6% this week after around 9% fall a week before. Persisting supply concerns continue to put pressure on the spot price turning the crude market structure a contango like.

What is contango?

- Very familiar term in the commodity market. Contango occurs when spot prices remain lower than future prices. This shows supply concern in future. Opposite is called backwardation.

Curve steepens -

- Crude producers can sell crude at $ 57.2/ barrel, when spot price is trading at $43/barrel. All they have to do is to sell the production at one year from now.

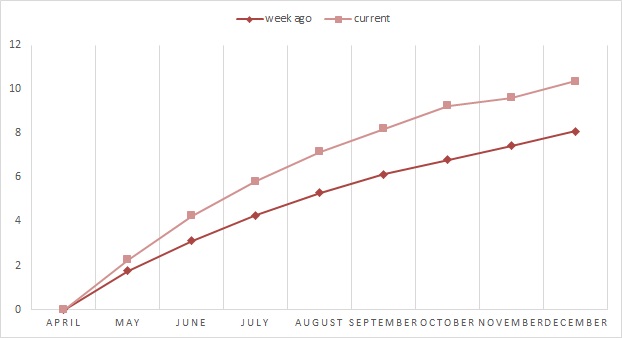

- 6 months contango curve is paying around $ 9.2/ barrel which is sufficient enough to fund the storage trade.

- Companies will keep producing the crude to avail cash in hand and to pay debt which they have accumulated since the easy monetary policy. Countries and state run companies will keep producing to maintain or gain market share. These mean spot price to remain depressed and contango to exacerbate.

- Current 6 months contango is sufficient enough to fund the floating storage in super containers. During 2008 super contango as much as 40 million barrels were stored at sea. This time may be similar is contango exacerbates further.

- With ECB and BOJ keeps monetary policies ultra-loose, cost of funding for such trade would be cheaper.

- In 2008, Super contango for 6 months reached $12.29/barrel, traders should watchful of that level.

Prices might finally reverse direction at the height of contango or backwardation. It is vital to keep an eye on the curve development.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?