Crude oil trades weak on demand concerns.It hit a high of $73.53 at the time of writing and is currently trading around $73.42.

hina’s manufacturing PMI slumped to a six-month low of 49.10 in August, below the forecast of 49.50. Services PMI came at 50.30 above the forecast of 50.10.

Major factors supporting higher Crude oil price

US dollar index - Bullish

US treasury yield- bullish (positive for commodity market).

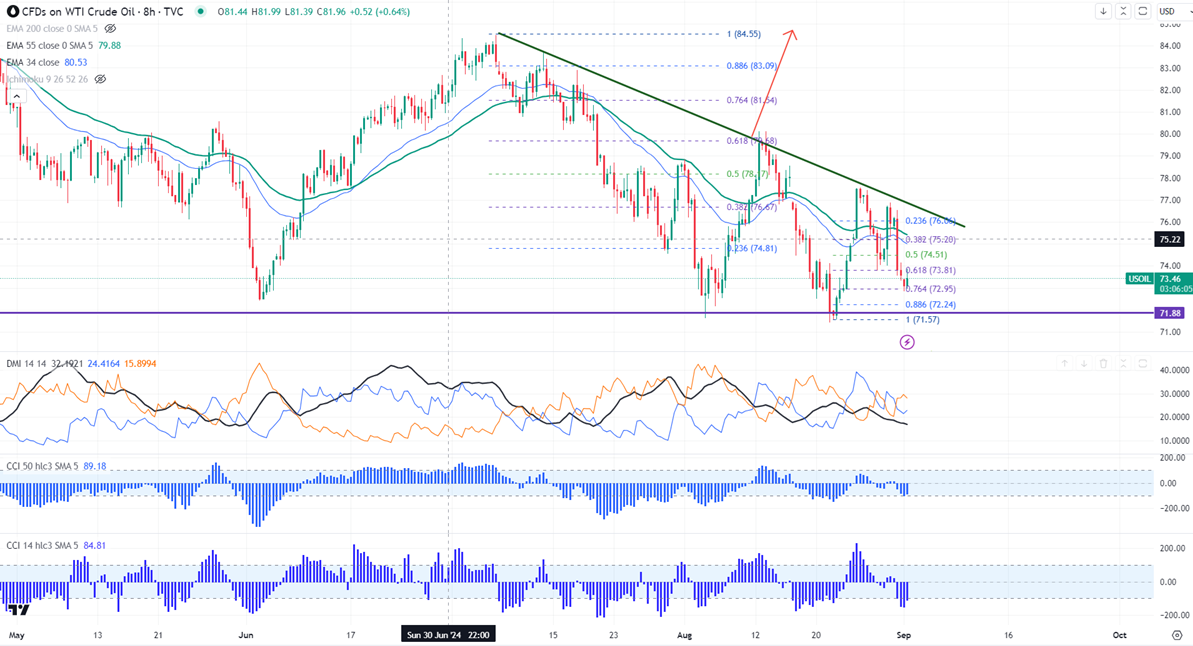

Major resistance- $73.80.Any breach above will take the commodity to the next level $74.15/$74.83/$75/$75.49. Major trend reversal only above $84.50.

The near-term support is around $72.80, any violation below targets $72/$71.50.

Indicators (4- hour chart)

ADX- Neutral

CCI (50) - Bearish

CCI (14)- Bearish

It is good to sell on rallies around $73.98-$74 with SL around $75 for TP of $71.70.