- EIA Crude inventories to be announced today: Inventory level of crude oil in the US decreased by 2.191 BBL/1Million in the week ended May 9th, 2015 as reported by the US EIA (Energy Information administration). It also affects the loonie due to Canada's sizable energy sector.

- West Texas Intermediate crude oil was down at 2.4% to $58.80 a barrel.

- Brent futures (July/Aug) spread at minus $0.50.

- Open Interest exceeding 3 million lots, equivalent to more than 3 billion barrels.

- Increased Access and Production: Recent 7% annual growth driven by improved mining infrastructure and technology.

- Upstream, Forties output was surprising to the upside.

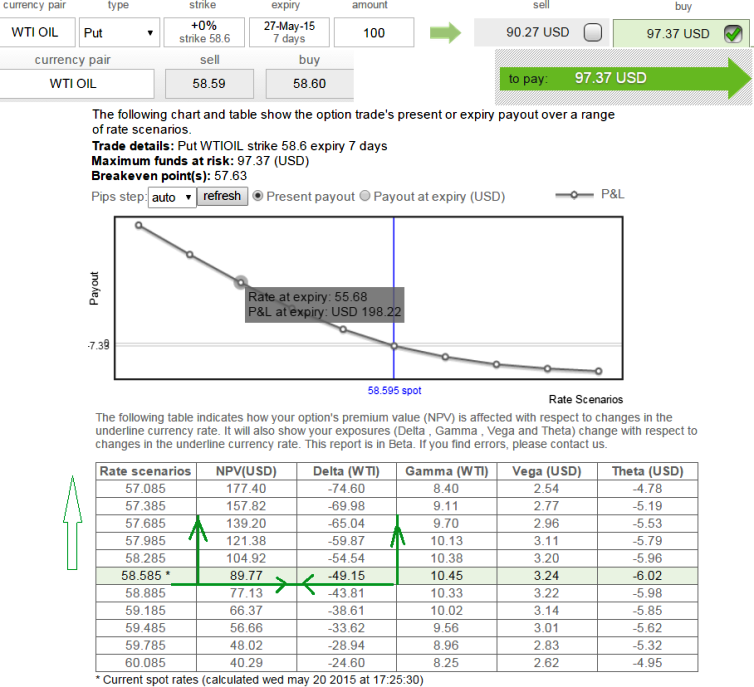

Hedging fall in crude through either using ATM Puts or short hedge

As shown in the figure reducing delta indicates high advantage in premiums of At-The-Money Puts with reducing underlying crude price. Hence, prevailing options prices offers favorable cost of hedging.

On Crude Oil manufacturer's perspective, the bears can use short hedge concept as well to lock in a future selling price for his production in continuity that is only ready for sale sometime in the future.

To execute the short hedge, crude oil producers short enough crude oil futures contracts in the futures market to cover the quantity of crude oil to be produced.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?