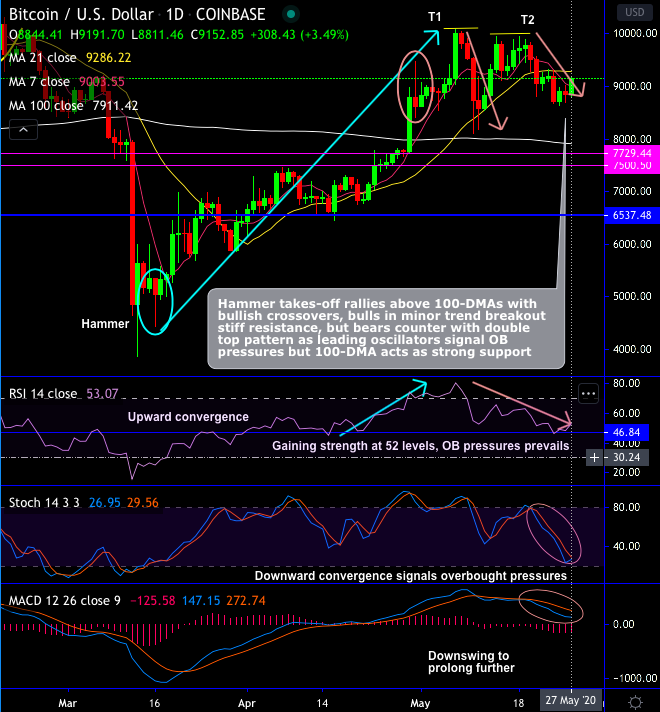

Although Bitcoin price has regained 2-3 days, it has been oscillating between tight range of $10k - $8k levels. BTCUSD (at coinbase) has rebounded back today with 3.74% gains so far.

Technically, hammer takes-off rallies above 100-DMAs with bullish crossovers, bulls in minor trend breakout stiff resistance, but bears counter with double top pattern as leading oscillators signal OB pressures but 100-DMA acts as strong support

While in recent times, the CME’s bitcoin derivatives products have sensed considerable growth with total open interest (OI) prints fresh all-time highs. The current BTC CME futures worth about $450 million in outstanding OI, showed a slight dip from recently observed highs of $532 million.

Well, almost half of this OI flowed through both options and futures are set to expire on Friday, on the flip side, the roll-over of these contracts to future months that determines some turbulence in the pioneer cryptocurrency.

Amid such volatility, as we could foresee strong support at $7,900 levels (i.e. 100-DMAs), long hedges have already been recommended, and we wish to uphold the same positions.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different