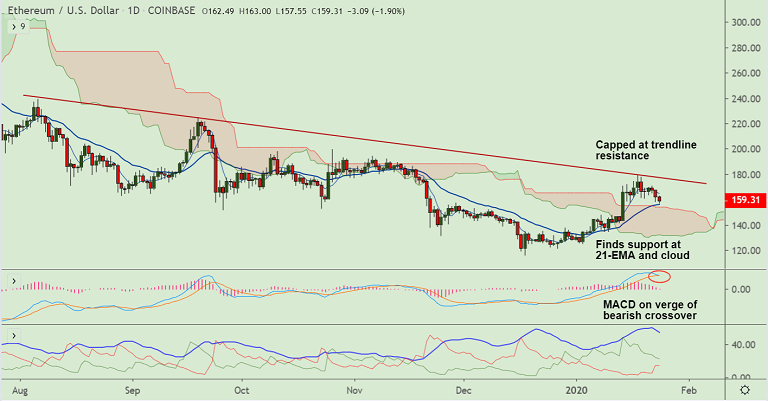

ETH/USD chart - Trading View

Exchange - Coinbase

Technical Analysis: Bias Bearish

Support: 156.31 (21-EMA); Resistance: 165.0 (5-DMA)

ETH/USD was trading 2.03% lower on the day at 159.07 at around 04:15 GMT, bias is bearish.

The pair is extending weakness below 200H MA and 'Death Cross' on the hourly charts adds to the bearish bias.

Positive momentum has faded away as pair paused upside shy of 200-DMA and technical indicators are now turning bearish.

5-DMA, Stochs and RSI are sharply lower and MACD is on verge of bearish crossover on signal line.

Price action has broken below 110-EMA which was strong support at 159.49. The pair is extending weakness below 200H MA.

Break below 21-EMA and daily cloud will see drag till 55-EMA at 151.56 ahead of 50-DMA at 142.97.

110-EMA is now immediate resistance at 159.49 ahead of 5-DMA at 164.94. Bullish continuation only above 200-DMA.