Of late, Bitcoin price has been drifting to make a trend-defining movement from the last couple of days, that ensures the prolonged sideways trading.

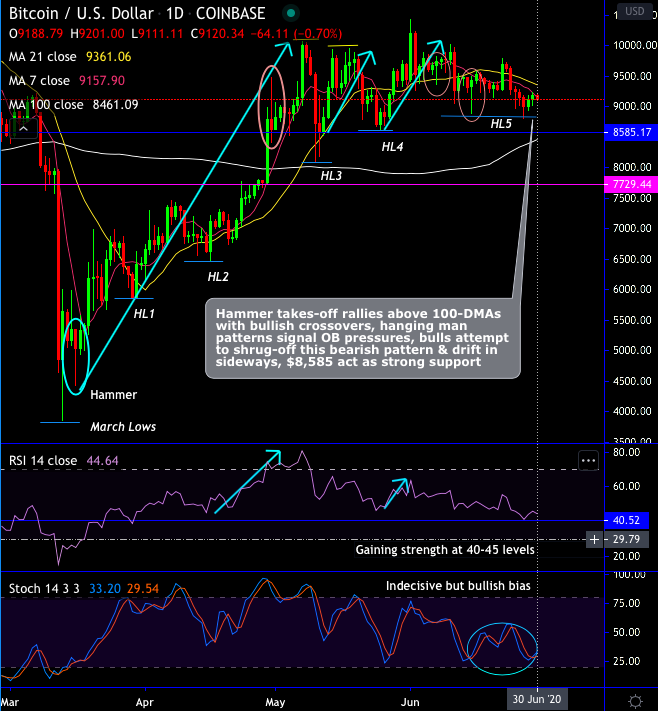

Technically, BTCUSD’s minor price trend (at Coinbase) is developing higher lows and hammer pattern at the bottom of $5,037 levels takes-off rallies above 100-DMAs with bullish crossovers. On the contrary, hanging man patterns pop-up at $9,750 and $9,432 levels to signal the overbought pressures, while bulls attempt to shrug-off these bearish patterns & drifting in sideways.

The minor trend has been developing higher lows (HLs), it has been maintaining unbroken so far despite minor price hiccups, we could foresee $8,585 act as strong support area.

On a broader perspective, Since mid-March, BTC has spiked from $3,858 to the current $10,079 which is 160% rallies. Bitcoin was positioned for a bull market before the coronavirus pandemic affected nearly all risk-on markets.

Bitcoin's put/call options ratio indicates rosy prospects as put (bearish) options total 40% of the current open interest which is down from an 80% pre-halving peak, as per the skew crypto-derivative data provider.

Nonetheless, this cannot be totally perceived as a bull/bear indicator by itself as many other factors, such as, which strike prices & tenors are needed to be considered. It cannot be studied in isolation.

Usually, derivatives in the current era, have been rather utilized for speculative instrument (but they are actually meant for hedging), but used with the objective of fetching capital gain or loss out of very negligible capital.

The major crypto derivatives products include futures, options and swaps. Crypto derivatives trading has been popular as it obtains leverage options to enhance profits (derives exponential yields).

Amid the prevailing pandemic Covid-19 ransacking the entire global financial systems now attempting to recover from the turmoil, the crypto derivatives marketplace began growing significantly, approaching all-time high volumes of $600 billion in March and crypto-backed both perpetual swap and futures contracts edged to another all-time high volume of $602 billion in May.

As we could foresee more upside risks in the days to come with the strong support of $7,950 levels (i.e. 100-DMAs), long hedges have already been advocated using CME BTC Futures when the underlying BTC was trading at $4,927 levels, and we wish to uphold the same positions with July months deliveries. It is unwise to keep speculating on the next upside target and accumulate fresh bitcoins. Instead, one can certainly uphold the above advocated long hedges for now (spot reference: 9,130 levels).

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields