The Bitcoin derivatives market has the new dimension after the introduction of the latest instruments like Bakkt’s BTC Futures, and news of CME’s bitcoin options in Q1-2019.

On the back of it, the underlying price of bitcoin (BTCUSD) has slid below $9k levels, the pair has shown price dips over $1145 or (-11.80%) in a single day yesterday.

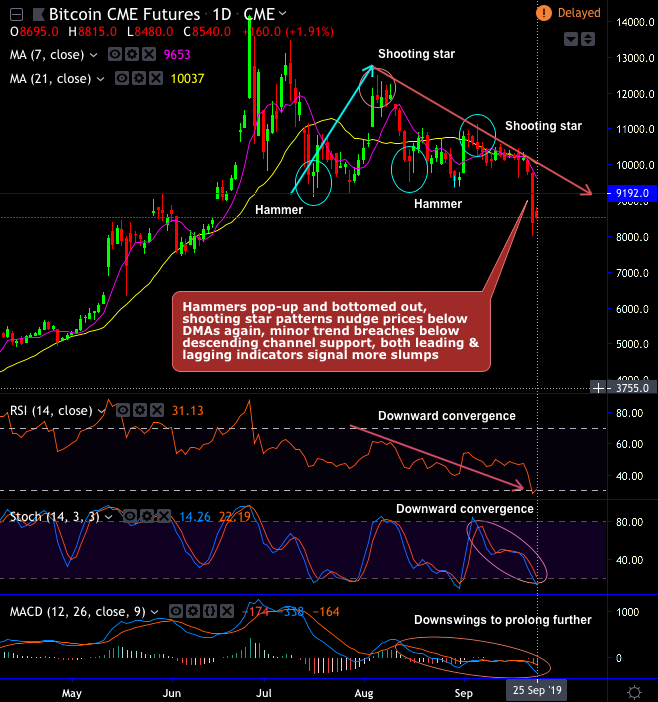

On the daily plotting of Bitcoin CME futures price chart, hammer pattern candlesticks at the bottom showed some minor strength in the interim rallies.

Contrary to these upswings, we traced out shooting star patterns at $11,830 and $10.460 levels, consequently, the bears nudge the bitcoin futures prices below 7 & 21-DMAs again. Amid these bearish sentiments, the minor trend breaches below descending channel support which is again a bearish indication, thereby, the short-term rallies now seemed to have been exhausted.

While the prices on a weekly-terms, back-to-back hanging man and shooting star patterns have occurred at peaks of rallies,

As a result, price slumps are in tandem with the bearish signals as predicted in our recent post. The current price is now trading below 21-EMAs, shorts in CME BTC of September month deliveries have been advocated, with the strong support at $9,192 - $9,359 levels being broken, we now wish to roll-over these shorts for October month deliveries as we could foresee further downside risks at this juncture.

Unlike Bakkt, these CME BTC futures contracts prices are cash-settled, would usually be subject to the CME CF Bitcoin Reference Rate (BRR) for the financial benchmarks. Renowned exchanges, such as GDAX, Bitstamp, Kraken, and itBit are the constituent exchanges to provide the required data for computation of BRR.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data