This year, crypto-derivatives space has established a remarkable milestone. Quite a few renowned exchanges have witnessed record volumes. While the OTC (Over-the-counter) trading desks are also coming up with new arrangements for crypto-derivatives.

The regulated bitcoin derivatives product volumes are still dominated by CME, whose total trading volumes are down 18.3% from August at 4.82 billion USD.

We’ve already emphasized in our recent posts that the summer peaks in bitcoin prices coincided with overbought conditions in both CME and BitMEX futures contracts.

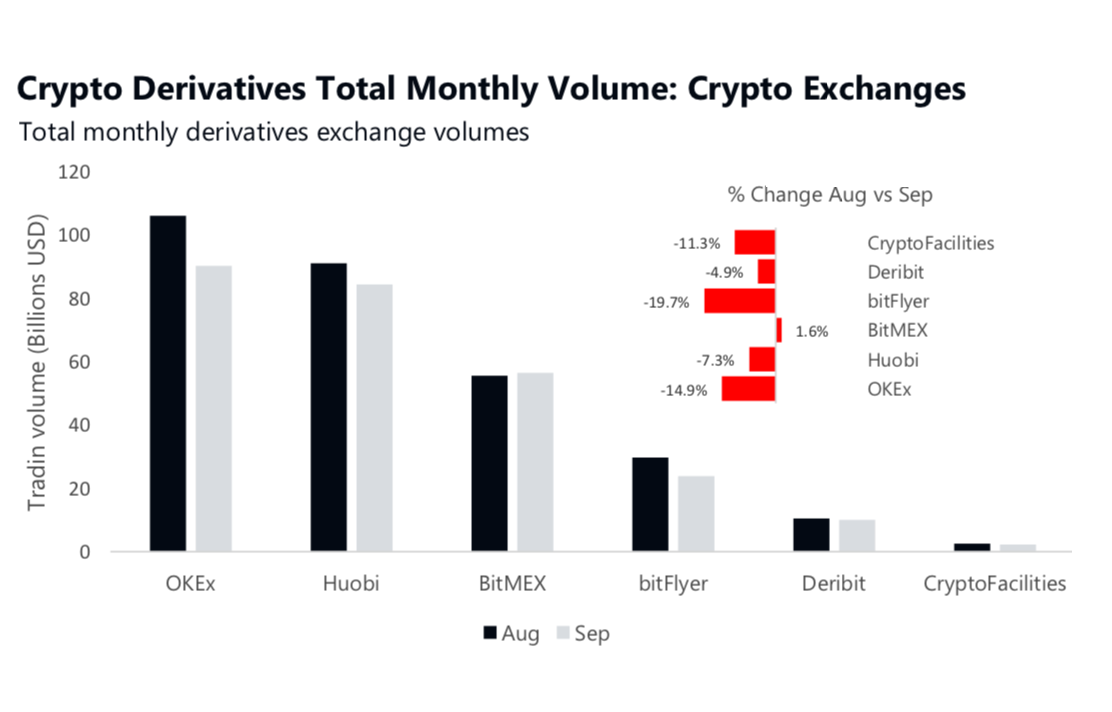

CryptoCompare’s Exchange Review is conducted on a monthly basis and caters to both the crypto-enthusiast interested in a broad overview of the crypto exchange market, as well as investors, analysts and regulators interested in more specific analyses. Wherein, OKEx was the top derivatives exchange in September, trading a total of 90.34 billion USD (down 14.9% from August). This was followed by Huobi with trading at 84.52 billion USD (down 7.3% from August). In terms of perpetual BTC futures products, BitMEX represent most of the market volume, trading totals of $41.7 Bln.

For now, OKEx’s derivatives desk offers perpetual swap and futures for cryptocurrencies. We’ve noted that the true level of institutional participation was likely greater than widely used trading volume figures implied, as a number of sources suggested that only around 5% of reported trading volume aggregated across cryptocurrency exchanges was genuine.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One