BTCV2019 (i.e. the prices of CME bitcoin futures front end month contract) has dropped below $8k level, thereby, the selling sentiments are intensified.

The CME’s bitcoin futures product volumes have also decreased from a total of 5.9 billion USD traded in August to a total of 4.82 billion USD traded in September.

Coindesk reports that the open interest, or the number of outstanding positions surged on CME to 4,629 contracts, up from 2,873 in the third quarter of 2018.

The rising volume of Bitcoin futures volume on CME in the last month is a key indicator of the positive sentiments from institutional investors. The number of investors going long on Bitcoin futures is rising. Bitcoin longs position on CME has stepped above 1,100 after grinding to almost zero.

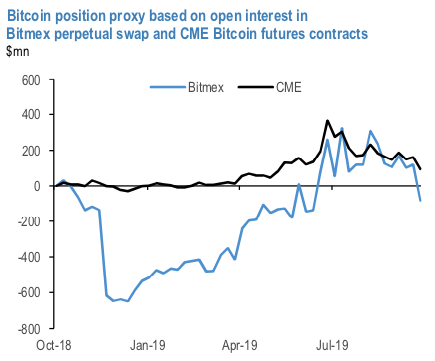

But, has an unwind of these positions contributed to the recent declines? To infer positioning in bitcoin futures we run you through open interest position proxy methodology, previously applied to other futures contracts as well, where we look at the cumulative weekly absolute changes in the open interest multiplied by the sign of the futures price change every week. The rationale behind this position proxy is that when there is a price increase, the net long position of spec investors’ increases also with the magnitude of the increase determined by the absolute change in the open interest. It does not matter whether the open interest rises or falls as the net long position can increase either via fresh longs (increase in open interest) or a reduction of previous shorts (reduction in open interest). And vice versa.

When there is a price decrease, the net long position of spec investors decreases also with the magnitude of the decrease determined by the absolute change in the open interest. It does not matter whether the open interest rises or falls as the net long position can decrease either via fresh shorts (increase in open interest) or reduction of previous longs (reduction in open interest).

The position proxies for the CME and BitMEX futures contacts are shown in above chart. The CME position proxy suggests the long base has declined markedly since their peak during the summer, and some further reduction this week.

By contrast, the BitMEX position proxy suggests a more marked capitulation of bitcoin longs over the past week. This position liquidation has also likely contributed to the sharp falls in bitcoin prices this week. But while the previous overhang of long bitcoin futures positions appears to have cleared in Bitmex futures, this is not yet true for CME contracts.

During the month of September, OKEx represented the majority of daily derivatives volumes trading at $3.0Bn per day (33.7% market share) followed by Huobi (2.82Bn, 31.6%), BitMEX ($1.88 Bn, 21.1%) and bitFlyer ($797 Mn, 8.9%).

Meanwhile, Grayscale’s bitcoin trust product (GBTC), decreased in terms of total trading volume with 713.6 million USD traded in September (down 37.5% from August). Courtesy: JPM

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate