RBC Capital Markets notes:

1-3 Month Outlook - More RBNZ easing

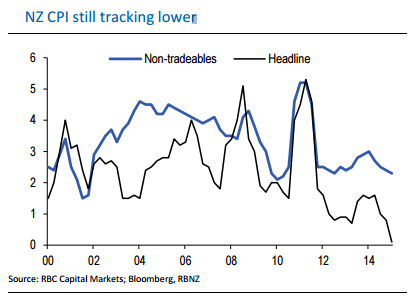

The RBNZ cut the policy rate last month, in line with RBC's expectations. But our economists do not think their work is done yet, and see a high probability for another cut in July. The case for easing has been developing through the first half of the year, with ongoing inflation disappointment, steadily weaker commodity prices of their main exports, and an exchange rate that the Bank still characterizes as overvalued. All of those factors are still present, and the message from the RBNZ suggests another cut is in the cards. In recent weeks the Bank has reiterated that the high level of the NZD is a headwind to the economy, even after the sharp depreciation since the June rate cut.

The dovish leaning comments from the RBNZ now has a July rate cut almost fully priced in, and by the end of the year the forward curve has more than two cuts priced. That suggests NZD may have limited downside in the next month or so even if the cut we are expecting is delivered. For the rest of the year, however, NZD/USD should continue to see pressure from a rate spread perspective with the help of the Fed likely hiking. Generally speaking, we continue to foresee the profile for NZD/USD as a trend lower, driven especially by policy divergence (RBNZ cutting while the Fed enters a hiking cycle).

6-12 Month Outlook - Gradually lower

Over the longer horizon we view the profile for NZD/USD as gently weaker, and we think AUD/NZD should trend higher into 2016. Beyond the additional cut we expect this year, we think more evidence of a softer terms-of-trade should maintain a weaker activity and employment outlook, and should keep the RBNZ with a neutral/soft dovish bias.

Capital flows are one reason for support to NZD considering New Zealand is the highest yielding currency in G10 (and will remain that way even after the another cut); however, the country's small bond market makes it difficult for global investors to pour money into NZ. That means there is a limited scope for unhedged FI flows to support NZD (as they do for example with AUD). Moreover, further out, NZ yields should look less attractive as the interest rate gap between other G10 economies narrows.

Currency Outlook: New Zealand Dollar

Tuesday, July 7, 2015 2:12 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX