RBC Capital Markets notes:

1-3 Month Outlook - Sustained outperformance

GBP performed very strongly again over the last month, gaining against all other G10 currencies and with EUR/GBP briefly dipping below 0.70 for a new seven year low. GBP's outperformance is largely a conventional interest rate expectations story. 2yr spreads widened in the UK's favour against every major market, with the exception of the European periphery. But despite GBP's outperformance since the UK general election, we think there is plenty more to go for going forward.

The OIS market does not have a full hike priced until May/June 2016 - far later than our economists' ongoing expectations of a November hike. If GDP rebounds in Q2 (as we expect), the housing market firms in line with its lead indicators and wage inflation maintains the acceleration seen in April (highly likely as it is the key month for pay settlements), we expect market rate expectations to converge to closer to our own.

The main near-term risk to our bullish GBP view is from fiscal policy. The July 8 Budget will no doubt be presented as a significant, front-end loaded, tightening of fiscal policy and, other things being equal, this would put downwards pressure on forward rates. However, with so little discounted as a starting point, this risk is not great and we would also note that the MPC has in past not shown great sensitivity to shifts in fiscal policy when setting rates.

6-12 Month Outlook - Referendum risk overstated

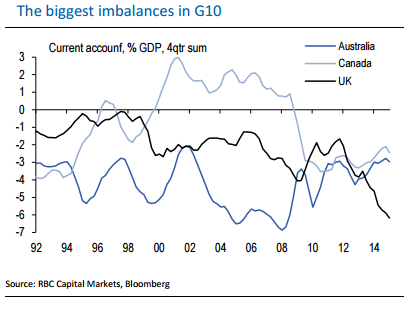

Longer-term, there are two key risks for GBP - the UK's unsustainable current account deficit (6.2% of GDP) and the EU referendum, promised for end-2017 at the latest. We think both are manageable, however. The current account deficit is the counterpart to the budget deficit domestically and so long as the upcoming fiscal strategy is credible, it should remain fundable. This would have been amuch greater risk under other, less certain, election outcomes.

When we looked in detail at the EU referendum risk, we concluded the UK electorate is probably less Eurosceptic than the most recent opinion polls imply. In the longer term, the balance of opinion has almost always been in favour of staying in and it still is when pollsters add a qualification that the government recommends voting to stay. We maintain a moderately constructive long-term view on GBP.

Currency Outlook: Sterling

Tuesday, July 7, 2015 12:37 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed