Dollar index trading at 97.36 (-0.26%)

Strength meter (today so far) - Aussie -0.26%, Kiwi +0.11%, Loonie +0.23%.

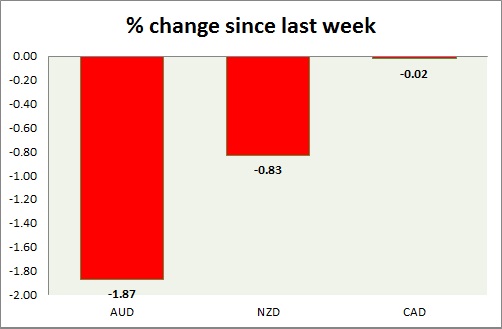

Strength meter (since last week) - Aussie -1.87%, Kiwi -0.83%, Loonie -0.02%.

AUD/USD -

Trading at 0.708

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Sell

Support -

- Long term - 0.60, Medium term - 0.69, Short term - 0.719-717

Resistance -

- Long term - 0.82, Medium term - 0.785 -0.79, Short term - 0.74

Economic release today -

- Export price index remained flat in third quarter, while import price index rose by 1.4%.

Commentary -

- Aussie Dollar continuing its drop against Dollar, over weaker inflation.

NZD/USD -

Trading at 0.668

Trend meter -

- Long term - Sell, Medium term - Range/sell, Short term - Range/Buy

Support -

- Long term - 0.56, Medium term - 0.625, Short term - 0.66

Resistance -

- Long term - 0.77, Medium term - 0.725, Short term - 0.7

Economic release today -

- RBNZ held policy steady at 2.75%.

Commentary -

- Kiwi however failed to gain ground as RBNZ hinted action in future.

USD/CAD -

Trading at 1.316

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support -

- Long term - 1.19, Medium term - 1.28, Short term - 1.303,

Resistance -

- Long term - 1.38, Medium term - 1.35, Short term - 1.34

Economic release today -

- NIL

Commentary -

- Loonie turned out to be the best performer of the week as oil price is up. However losing momentum.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings