Dollar index trading at 88.88 (-0.34%)

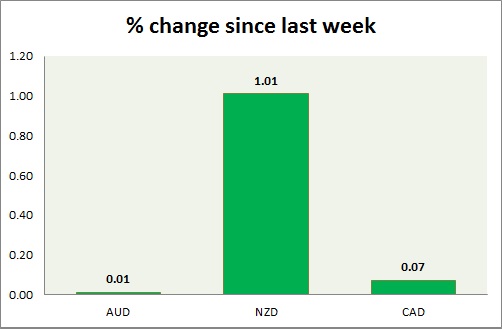

Strength meter (today so far) – Aussie +0.09%, Kiwi +0.94%, Loonie +0.44%

Strength meter (since last week) – Aussie -0.16%, Kiwi -0.03%, Loonie -0.33%

AUD/USD –

Trading at 0.811

Trend meter –

- Long term – Range/Buy, Medium term – Buy, Short term – Range/Sell

Support –

- Long term – 0.746, Medium term – 0.75, Short term – 0.765

Resistance –

- Long term – 0.85, Medium term – 0.825, Short term – 0.825

Economic release today –

- Private sector credit grew 4.8 percent y/y in December.

- Consumer price inflation is up 1.9 percent y/y in the fourth quarter. RBA trimmed mean is up 1.8 percent y/y.

Commentary –

- Aussie is flat for the week.

NZD/USD -

Trading at 0.741

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Range/Sell

Support –

- Long term – 0.68, Medium term – 0.69, Short term – 0.71

Resistance –

- Long term – 0.76, Medium term – 0.735, Short term – 0.735 (testing)

Economic release today –

- NIL

Commentary –

- Kiwi is the best performer of the week on robust trade balance for December and positive credit outlook by S&P rating agency.

USD/CAD –

Trading at 1.228

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.2, Medium term – 1.22, Short term – 1.22

Resistance –

- Long term – 1.3, Medium term – 1.28, Short term – 1.24

Economic release today –

- Industrial product price and raw material price reports will be released at 13:30 GMT.

- November GDP report will be released at 13:30 GMT.

Commentary –

- Loonie is almost flat for the week.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022