Dollar index trading at 94.61 (+0.02%)

Strength meter (today so far) – Aussie +0.06%, Kiwi +0.16%, Loonie -0.02%

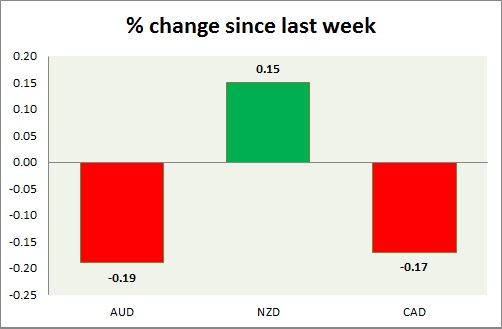

Strength meter (since last week) – Aussie -0.19%, Kiwi +0.15%, Loonie -0.17%

AUD/USD –

Trading at 0.738

Trend meter –

- Long term – Range/Sell, Medium term – Buy, Short term – Range/Buy

Support –

- Long term – 0.7, Medium term – 0.72, Short term – 0.72

Resistance –

- Long term – 0.825, Medium term – 0.79, Short term – 0.76

Economic release today –

- Trade balance came at $0.83 billion in May with exports up 4 percent and imports up 3 percent.

Commentary –

- Aussie is struggling amid trade uncertainty and a stronger dollar. However, recovered large sections of earlier loss.

NZD/USD -

Trading at 0.676

Trend meter -

- Long term – Sell, Medium term – Sell, Short term – Range/Sell

Support –

- Long term – 0.62, Medium term – 0.65, Short term – 0.67 (testing)

Resistance –

- Long term – 0.735, Medium term – 0.735, Short term – 0.705

Economic release today –

- ANZ commodity price is down 1 percent in June.

Commentary –

- Kiwi has decisively broken support near 0.69 area and likely to go down further. Active Call - Sell kiwi targeting 0.62 area.

USD/CAD –

Trading at 1.314

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.26, Medium term – 1.29, Short term – 1.31

Resistance –

- Long term – 1.35, Medium term – 1.33, Short term – 1.33

Economic release today –

- NIL

Commentary –

- Loonie is struggling over trade tensions with the United States despite a weaker dollar. Recovered some of the earlier loss.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed