Dollar index trading at 94.90 (+0.26%)

Strength meter (today so far) – Aussie -0.40%, Kiwi -0.56%, Loonie -0.10%

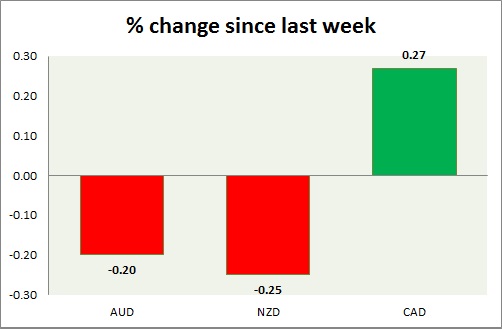

Strength meter (since last week) – Aussie -0.20%, Kiwi -0.25%, Loonie +0.27%

AUD/USD –

Trading at 0.738

Trend meter –

- Long term – Range/Sell, Medium term – Buy, Short term – Range/Buy

Support –

- Long term – 0.7, Medium term – 0.72, Short term – 0.72

Resistance –

- Long term – 0.825, Medium term – 0.79, Short term – 0.76

Economic release today –

- June trade balance came at $1.87 billion with exports rising by 3 percent, while imports declined by 1 percent.

Commentary –

- Aussie gave up earlier gains as the dollar rebounds on hawkish FOMC. However, the consolidation is continuing with the dollar lacking clear medium-term direction.

NZD/USD -

Trading at 0.676

Trend meter -

- Long term – Sell, Medium term – Sell, Short term – Range/Sell

Support –

- Long term – 0.62, Medium term – 0.65, Short term – 0.67

Resistance –

- Long term – 0.735, Medium term – 0.735, Short term – 0.705

Economic release today –

- NIL

Commentary –

- Kiwi is continuing to test support around 0.67 area. The worst performer of the week so far. Active Call - Sell kiwi targeting 0.62 area.

USD/CAD –

Trading at 1.301

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.26, Medium term – 1.29, Short term – 1.3

Resistance –

- Long term – 1.35, Medium term – 1.33, Short term – 1.32

Economic release today –

- NIL

Commentary –

- Loonie is the best performer of the week on NAFTA hopes.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed