Dollar index trading at 95.41 (+0.34%)

Strength meter (today so far) – Aussie -0.05%, Kiwi +0.10%, Loonie +0.12%

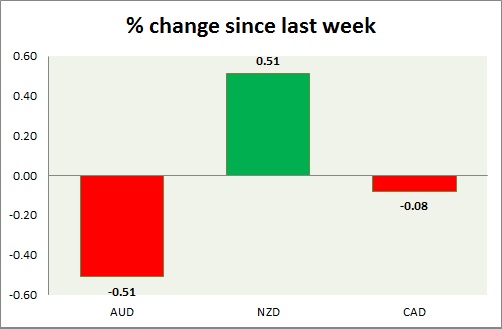

Strength meter (since last week) – Aussie -0.51%, Kiwi +0.51%, Loonie -0.08%

AUD/USD –

Trading at 0.727

Trend meter –

- Long term – Range/Sell, Medium term – Buy, Short term – Range/Buy

Support –

- Long term – 0.7, Medium term – 0.72, Short term – 0.72

Resistance –

- Long term – 0.825, Medium term – 0.79, Short term – 0.76

Economic release today –

- NIL

Commentary –

- The Australian dollar is struggling as the country’s Prime Minister Malcolm Turnbull is set to face a fresh leadership challenge.

NZD/USD -

Trading at 0.666

Trend meter -

- Long term – Sell, Medium term – Sell, Short term – Range/Sell

Support –

- Long term – 0.62, Medium term – 0.65, Short term – 0.65

Resistance –

- Long term – 0.725, Medium term – 0.7, Short term – 0.675

Economic release today –

- July trade balance report will be released at 22:45 GMT.

Commentary –

- The New Zealand dollar is the best performer of the week so far. Active Call - Sell kiwi targeting 0.62 area.

USD/CAD –

Trading at 1.307

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.26, Medium term – 1.29, Short term – 1.3

Resistance –

- Long term – 1.35, Medium term – 1.33, Short term – 1.32

Economic release today –

- Retail sales down 0.2 percent in June.

Commentary –

- Loonie is focused on looming NAFTA deal with the United States. Marginally down this week.