Dollar index trading at 94.92 (+0.22%)

Strength meter (today so far) – Aussie -0.72%, Kiwi -0.26%, Loonie -0.45%

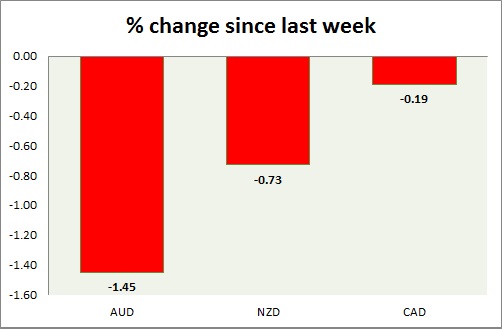

Strength meter (since last week) – Aussie -1.45%, Kiwi -0.73%, Loonie -0.19%

AUD/USD –

Trading at 0.721

Trend meter –

- Long term – Range/Sell, Medium term – Buy, Short term – Range/Buy

Support –

- Long term – 0.7, Medium term – 0.72, Short term – 0.72

Resistance –

- Long term – 0.825, Medium term – 0.79, Short term – 0.76

Economic release today –

- Private sector credit up 4.4 percent y/y in July.

Commentary –

- The Australian dollar is the worst performer of the week on EM concern.

NZD/USD -

Trading at 0.663

Trend meter -

- Long term – Sell, Medium term – a Sell, Short term – Range/Sell

Support –

- Long term – 0.62, Medium term – 0.65, Short term – 0.65

Resistance –

- Long term – 0.725, Medium term – 0.7, Short term – 0.675

Economic release today –

- NIL.

Commentary –

- The New Zealand dollar is moving lower along with the Aussie. Active Call - Sell kiwi targeting 0.62 area.

USD/CAD –

Trading at 1.304

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.26, Medium term – 1.29, Short term – 1.3

Resistance –

- Long term – 1.35, Medium term – 1.33, Short term – 1.32

Economic release today –

- Raw material price index up 0.7 percent y/y in July, while Industrial product price index down 0.2 percent.

Commentary –

- Loonie is the best performer of the week on NAFTA hopes but down against the USD as a deal is yet not reached.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022