Dollar index trading at 94.38 (-0.13%)

Strength meter (today so far) – Aussie +0.98%, Kiwi +0.42%, Loonie +0.54%

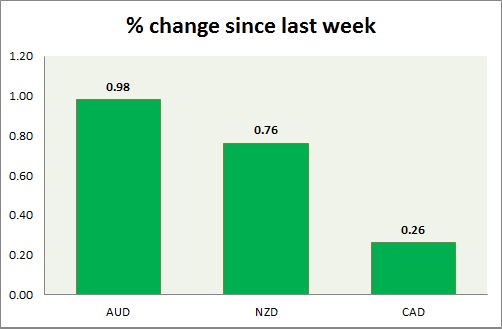

Strength meter (since last week) – Aussie +0.98%, Kiwi +0.76%, Loonie +0.26%

AUD/USD –

Trading at 0.721

Trend meter –

- Long term – Range/Sell, Medium term – Buy, Short term – Range/Buy

Support –

- Long term – 0.67, Medium term – 0.7, Short term – 0.72 (testing)

Resistance –

- Long term – 0.825, Medium term – 0.79, Short term – 0.75

Economic release today –

- House price index down 0.6 percent y/y in Q2.

Commentary –

- The Australian dollar is up this week against a weaker USD. However, bias remains to the downside.

NZD/USD -

Trading at 0.659

Trend meter -

- Long term – Sell, Medium term – Sell, Short term – Range/Sell

Support –

- Long term – 0.62, Medium term – 0.65, Short term – 0.65

Resistance –

- Long term – 0.725, Medium term – 0.7, Short term – 0.675

Economic release today –

- Global dairy auction is scheduled today.

Commentary –

- The New Zealand dollar is up on a weaker dollar, despite emerging markets trouble. Active Call - Sell kiwi targeting 0.59 area.

USD/CAD –

Trading at 1.299

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.26, Medium term – 1.29, Short term – 1.3 (testing)

Resistance –

- Long term – 1.35, Medium term – 1.33, Short term – 1.32

Economic release today –

- Manufacturing shipments up 0.9 percent in July.

Commentary –

- Loonie is the worst performer of the week on trade tensions. Active Call - Sell USD/CAD at 1.314 targeting 1.25 area.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed