Dollar index trading at 95.72 (-0.28%)

Strength meter (today so far) – Aussie -0.19%, Kiwi -0.09%, Loonie -0.00%

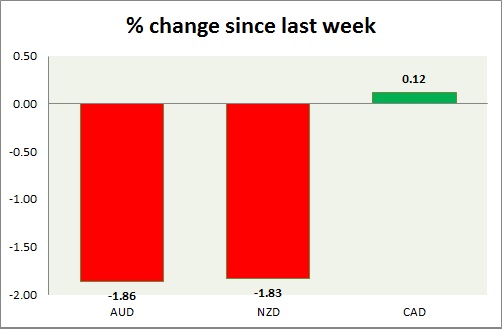

Strength meter (since last week) – Aussie -1.86%, Kiwi -1.83%, Loonie +0.12%

AUD/USD –

Trading at 0.708

Trend meter –

- Long term – Range/Sell, Medium term – Buy, Short term – Range/Buy

Support –

- Long term – 0.67, Medium term – 0.7, Short term – 0.72 (broken)

Resistance –

- Long term – 0.825, Medium term – 0.79, Short term – 0.75

Economic release today –

- August trade balance came at $1.604 billion.

Commentary –

- The Australian dollar is likely to decline further as the emerging market woes and strong dollar continues to dominate

NZD/USD -

Trading at 0.649

Trend meter -

- Long term – Sell, Medium term – Sell, Short term – Range/Sell

Support –

- Long term – 0.62, Medium term – 0.65, Short term – 0.65

Resistance –

- Long term – 0.725, Medium term – 0.7, Short term – 0.675

Economic release today –

- NIL

Commentary –

- The New Zealand dollar is declining as RBNZ vows to keep rate at this level through 2019 and 2020. Active Call - Sell kiwi targeting 0.59 area.

USD/CAD –

Trading at 1.289

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.26, Medium term – 1.29, Short term – 1.29 (broken)

Resistance –

- Long term – 1.35, Medium term – 1.33, Short term – 1.32

Economic release today –

- IVEY PMI declined sharply to 50.4 in September.

Commentary –

- Loonie is the best performer of the week as Canada reaches trade agreement with the United States. Active Call - Sell USD/CAD at 1.314 targeting 1.25 area.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022