Dollar index trading at 96.22 (+0.23%)

Strength meter (today so far) – Aussie +0.14%, Kiwi +0.21%, Loonie -0.08%

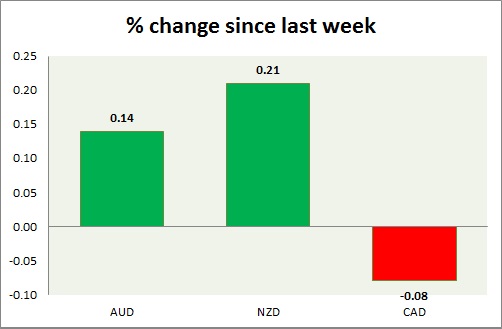

Strength meter (since last week) – Aussie +0.14%, Kiwi +0.21%, Loonie -0.08%

AUD/USD –

Trading at 0.729

Trend meter –

- Long term – Range/Sell, Medium term – sell, Short term – Range/sell

Support –

- Long term – 0.67, Medium term – 0.67, Short term – 0.69

Resistance –

- Long term – 0.79 Medium term – 0.75, Short term – 0.72 (broken)

Economic release today –

- NIL

Commentary –

- The Australian dollar is likely to decline further as the emerging market woes and strong dollar continues to dominate but Aussie rose sharply since last week, on the broad based weakness in USD.

NZD/USD -

Trading at 0.679

Trend meter -

- Long term – Sell, Medium term – Sell, Short term – Range/Sell

Support –

- Long term – 0.62, Medium term – 0.65, Short term – 0.65 (testing)

Resistance –

- Long term – 0.725, Medium term – 0.7, Short term – 0.675

Economic release today –

- NIL

Commentary –

- The New Zealand dollar remains under pressure as RBNZ vows to keep the rate at this level through 2019 and 2020. The best performer since last week on weak USD. Active Call - Sell kiwi targeting 0.59 area.

USD/CAD –

Trading at 1.311

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.26, Medium term – 1.29, Short term – 1.29

Resistance –

- Long term – 1.35, Medium term – 1.33, Short term – 1.32

Economic release today –

- NIL

Commentary –

- Loonie is the worst performer of the week as lower oil price weigh. Active Call - Sell USD/CAD at 1.314 targeting 1.25 area.