Dollar index trading at 95.77 (-0.37%)

Strength meter (today so far) – Aussie +0.39%, Kiwi +0.58%, Loonie +0.19%

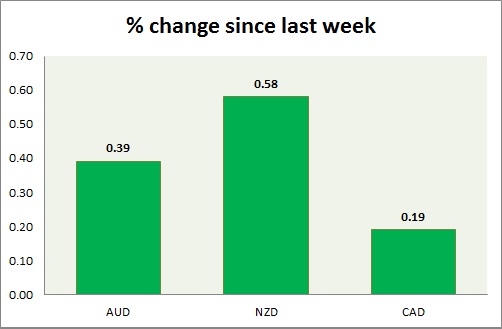

Strength meter (since last week) – Aussie +0.39%, Kiwi +0.58%, Loonie +0.19%

AUD/USD –

Trading at 0.713

Trend meter –

- Long term – Range/Sell, Medium term – sell, Short term – Range/sell

Support –

- Long term – 0.67, Medium term – 0.69, Short term – 0.7

Resistance –

- Long term – 0.79 Medium term – 0.75, Short term – 0.732

Economic release today –

- Private sector credit grew 0.3 percent in November, up 4.4 percent from a year ago.

Commentary –

- The Australian is trading in a tight range. The focus is on Sino-American trade talks.

NZD/USD -

Trading at 0.676

Trend meter -

- Long term – Sell, Medium term – Sell, Short term – Range/sell

Support –

- Long term – 0.62, Medium term – 0.65, Short term – 0.66

Resistance –

- Long term – 0.735, Medium term – 0.72, Short term – 0.695

Economic release today –

- NIL

Commentary –

- The New Zealand dollar remains upbeat as the economy remains robust and as the USD weakens. Active Call - Sell kiwi targeting 0.59 area.

USD/CAD –

Trading at 1.359

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.26, Medium term – 1.29, Short term – 1.315

Resistance –

- Long term – 1.365, Medium term – 1.35, Short term – 1.35

Economic release today –

- IVEY PMI report will be released at 15:00 GMT.

Commentary –

- Loonie is the worst performer of the day but higher on weaker USD.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed