Dollar index trading at 93.51 (+0.32%)

Strength meter (today so far) – Aussie +0.24%, Kiwi +0.00%, Loonie +0.25%

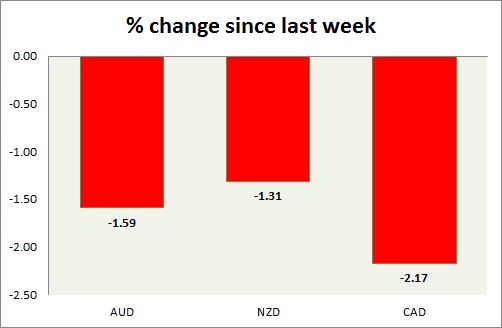

Strength meter (since last week) – Aussie -1.59%, Kiwi -1.31%, Loonie -2.17%

AUD/USD –

Trading at 0.747

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Buy

Support –

- Long term – 0.683, Medium term – 0.728, Short term – 0.742

Resistance –

- Long term – 0.82, Medium term – 0.79, Short term – 0.79

Economic release today –

- HIA new home sales rose 8.9% in March.

- 4% rise in exports and 1% rise in imports helped March trade deficit decline to -$2.16 billion.

- Retail sales rose 0.4% in March.

- AiG services PMI will be released at 23:30 GMT.

Commentary –

- Active call – Sell Aussie against Dollar @0.75 targeting 0.7 area, with stop loss around 0.785

NZD/USD –

Trading at 0.688

Trend meter –

- Long term – Sell, Medium term – Range, Short term – Range

Support –

- Long term – 0.56, Medium term – 0.62, Short term – 0.643

Resistance –

- Long term – 0.77, Medium term – 0.724, Short term – 0.724

Economic release today –

- NIL

Commentary –

- Kiwi is flat today, best performer of the week.

USD/CAD –

Trading at 1.284

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 1.19, Medium term – 1.22 , Short term – 1.25

Resistance –

- Long term – 1.334, Medium term – 1.32, Short term – 1.3

Economic release today –

- Building permits will be released at 12:30 GMT.

Commentary –

- Loonie remains worst performer this week on weaker oil, higher trade deficit and dovish Poloz.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX