Dollar index trading at 95.56 (-0.06%)

Strength meter (today so far) – Aussie +0.21%, Kiwi +0.19%, Loonie +0.08%

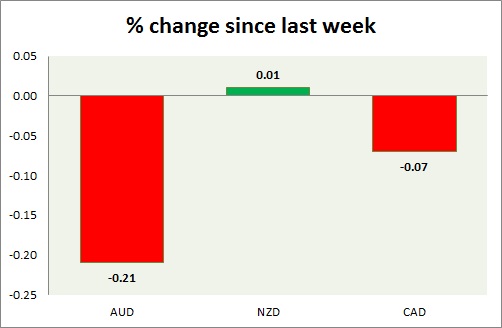

Strength meter (since last week) – Aussie -0.21%, Kiwi +0.01%, Loonie -0.07%

AUD/USD –

Trading at 0.72

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Buy

Support –

- Long term – 0.683, Medium term – 0.7, Short term – 0.7

Resistance –

- Long term – 0.82, Medium term – 0.79, Short term – 0.79

Economic release today –

- Construction work done declined -2.6% in first quarter

Commentary –

- Aussie recovered ground as Dollar retreated. Active call – Sell Aussie against Dollar @0.75 targeting 0.7 area, with stop loss around 0.785

NZD/USD –

Trading at 0.676

Trend meter –

- Long term – Sell, Medium term – Range, Short term – Range/Buy

Support –

- Long term – 0.56, Medium term – 0.62, Short term – 0.643

Resistance –

- Long term – 0.77, Medium term – 0.724, Short term – 0.724

Economic release today –

- Trade balance for April will be announced at 22:45 GMT.

Commentary –

- Kiwi is best performer this week as trade data surprised on the upside.

USD/CAD –

Trading at 1.311

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.19, Medium term – 1.22 , Short term – 1.25

Resistance –

- Long term – 1.334, Medium term – 1.32, Short term – 1.32

Economic release today –

- BOC will announce monetary policy decision at 14:00 GMT.

Commentary –

- Loonie is consolidating above 1.32 support handle. Focus is on BOC monetary policy today.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX