Dollar index trading at 95.92 (+0.08%)

Strength meter (today so far) – Aussie +0.13%, Kiwi +0.61%, Loonie -0.23%

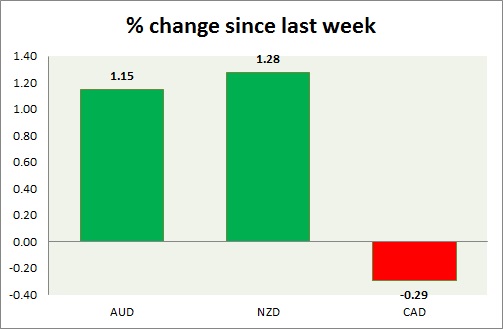

Strength meter (since last week) – Aussie +1.15%, Kiwi +1.28%, Loonie -0.29%

AUD/USD –

Trading at 0.755

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Range

Support –

- Long term – 0.683, Medium term – 0.72, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.765, Short term – 0.765

Economic release today –

- House price index rose 2 percent in the second quarter, up 4.1 percent from a year back.

Commentary –

- The Australian dollar is flat today but more than a percent this week on higher commodities prices. Active call – Buy AUD/USD at 0.752 and at dip with the stop loss at 0.71 and the target at 0.82

NZD/USD –

Trading at 0.735

Trend meter –

- Long term – Sell, Medium term – Range, Short term – range

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.73

Economic release today –

- Global dairy auction scheduled for today.

Commentary –

- The Kiwi is the best performer this week as milk prices recover. We expect kiwi to rise towards 0.81 area.

USD/CAD –

Trading at 1.323

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range

Support –

- Long term – 1.248, Medium term – 1.25 , Short term – 1.25

Resistance –

- Long term – 1.34, Medium term – 1.325, Short term – 1.325

Economic release today –

- BoC governor Poloz is scheduled to speak at 16:45 GMT.

Commentary –

- The Canadian dollar remains the worst performer of the week on weaker oil price.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed