Dollar index trading at 94.58 (-0.04%).

Strength meter (today so far) - Aussie +0.42%, Kiwi +0.47%, Loonie -0.01%.

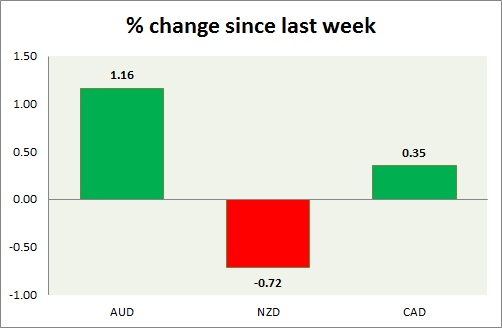

Strength meter (since last week) - Aussie +1.16%, Kiwi -0.72%, Loonie +0.35%.

AUD/USD -

Trading at 0.793

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Buy Support

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.79-0.80

Economic release today -

- NIL

Commentary -

- Aussie bulls remain in control however struggling to break 0.80 resistance area. Range might continue further. Risk reward remains very favorable for short position. Weak Chinese import providing headwinds for bulls.

NZD/USD -

Trading at 0.747

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell resistance

Support -

- Long term - 0.653, Medium term - 0.719-0.712, Short term - 0.738-0.736, Immediate - 0.744-0.741

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.768-0.772

Economic release today -

- NIL

Commentary -

- Kiwi has bounced back from immediate support, however buy positions are not recommended as bears remain in control.

USD/CAD -

Trading at 1.211

Trend meter -

- Long term - Buy, Medium term - Range/Sell, Short term - Range/Sell

Support -

- Long term - 1.17, Medium term - 1.1840-1.18, Short term - 1.20-1.196

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.235-1.241, Immediate - 1.225-1.228

Economic release today -

- Unemployment rate dropped to 6.8%, however employed dropped 19700. Lower participation led to drop in unemployment rate.

Commentary -

- Pair might consolidate here, until further cue arrives. Pair might even to move up to test resistance around 1.23 id oil continue to drop.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary