Dollar index trading at 100.5 (+0.03%)

Strength meter (today so far) – Aussie -0.38%, Kiwi -0.26%, Loonie -0.06%

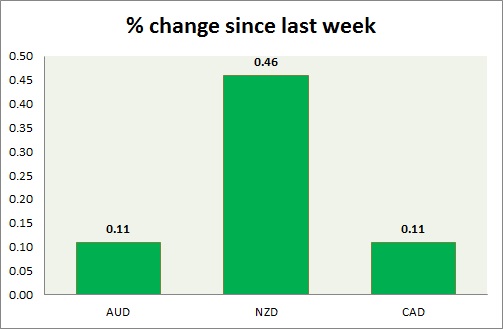

Strength meter (since last week) – Aussie +0.11%, Kiwi +0.46%, Loonie +0.11%

AUD/USD –

Trading at 0.745

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Buy

Support –

- Long term – 0.683, Medium term – 0.72, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.765, Short term – 0.765

Economic release today –

- Third deficit for October came at 1.54 billion.

Commentary –

- The Australian dollar is struggling below key 0.75 area. Active call – Buy AUD/USD at 0.752 and at dip with the stop loss at 0.71 and the target at 0.82

NZD/USD –

Trading at 0.716

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.73

Economic release today –

- Electronic card retail sales report will be released at 21:45 GMT.

Commentary –

- The kiwi regained all of its loss from the Prime Minister’s resignation. We expect kiwi to rise towards 0.81 area.

USD/CAD –

Trading at 1.324

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.28, Medium term – 1.3 , Short term – 1.32

Resistance –

- Long term – 1.38, Medium term – 1.365, Short term – 1.365

Economic release today –

- Housing starts for November declined to 184,000.

- Building permits rose by 8.7 percent in October.

- New house prices rose by 0.4 percent in October, up 3 percent from a year ago.

Commentary –

- The Canadian dollar is a much better performer after BoC kept rates on hold. We expect the loonie to reach 1.375 and 1.4.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed