Dollar index trading at 100.66 (+0.40%)

Strength meter (today so far) – Aussie -0.20%, Kiwi -0.28%, Loonie -0.31%

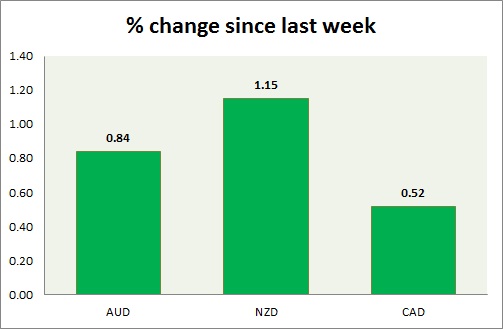

Strength meter (since last week) – Aussie +0.84%, Kiwi +1.15%, Loonie +0.52%

AUD/USD –

Trading at 0.755

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Buy

Support –

- Long term – 0.683, Medium term – 0.72, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.765, Short term – 0.765

Economic release today –

- Home loans rose by 0.9 percent in November, while investment lending for homes up 4.9 percent.

- Motor vehicle sales up 0.2 percent y/y in December.

Commentary –

- The Aussie has burst through the 0.75 area as the dollar weakened. After a big rise yesterday, it is down today on profit booking.

NZD/USD –

Trading at 0.719

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.73

Economic release today –

- Global diary auction is scheduled today.

Commentary –

- After a big rise yesterday, the kiwi dollar is retracing today.

USD/CAD –

Trading at 1.304

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.28, Medium term – 1.3 , Short term – 1.3

Resistance –

- Long term – 1.38, Medium term – 1.365, Short term – 1.365

Economic release today –

- NIL

Commentary –

- Loonie is the worst performer of the day. We expect the loonie to reach 1.375 and 1.4.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX