Dollar index trading at 96.02 (-0.25%)

Strength meter (today so far) - Aussie -0.07%, Kiwi +0.22%, Loonie +0.20%.

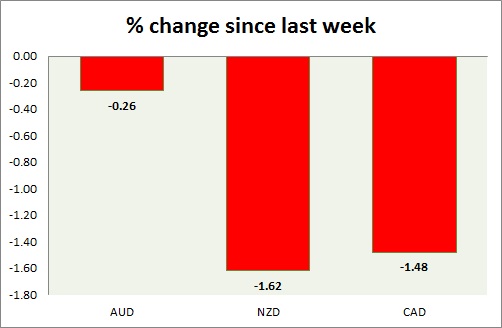

Strength meter (since last week) - Aussie -0.26%, Kiwi -1.62%, Loonie -1.48%.

AUD/USD -

Trading at 0.763

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.793-0.796

Economic release today -

- Australia trade balance came at -$2.5 billion in May with exports growing 1% and imports dropping -4%.

Commentary -

- Aussie is at support area and might break the support, since it failed to jump back substantially.

NZD/USD -

Trading at 0.673

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/sell resistance

Support -

- Long term - 0.653, Medium term - 0.65, Short term - 0.65

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.737-0.74, Immediate - 0.705

Economic release today -

- ANZ commodity prices dropped by -3.1% in June

Commentary -

- Kiwi might bounce back from this area as NFP report was weaker than expected.

USD/CAD -

Trading at 1.256

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.17, Medium term - 1.1840-1.18, Short term - 1.217-1.213

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.28. Immediate - 1.25 (broken)

Economic release today -

- Manufacturing PMI came at 51.3 in June compared to 49.8 prior.

Commentary -

- Canadian dollar traded as low as 1.263 against dollar, however bounced back after weaker than expected NFP pushed dollar down.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings