Dollar index trading at 95.82 (-0.46%)

Strength meter (today so far) - Aussie -0.39%, Kiwi -0.60%, Loonie +0.05%.

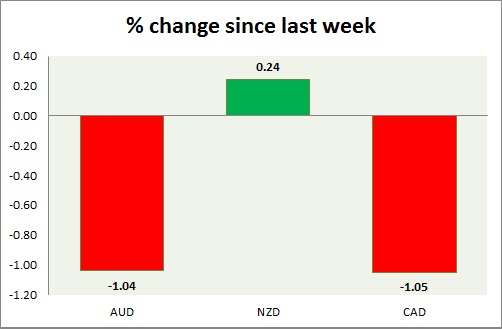

Strength meter (since last week) - Aussie -1.04%, Kiwi +0.24%, Loonie -1.05%.

AUD/USD -

Trading at 0.743

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.71

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.793-0.796

Economic release today -

- Home loans dropped -6.1% in May, while investment lending dropped -3.2%

Commentary -

- Sell Aussie with stop around 0.785 and 0.825 to target 0.715, 0.70 and 0.65.

NZD/USD -

Trading at 0.67

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/sell resistance

Support -

- Long term - 0.653, Medium term - 0.65, Short term - 0.65

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.737-0.74, Immediate - 0.705

Economic release today -

- NIL

Commentary -

- Kiwi trading water above 0.65 support, might gain against Aussie.

USD/CAD -

Trading at 1.27

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.17, Medium term - 1.1840-1.18, Short term - 1.217-1.213

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.28.

Economic release today -

- Employed dropped by -6400, unemployment rate remained stable at 6.8%

Commentary -

- Canadian dollar remains sell against dollar, the pair might reach as high as 1.38, however it recovered somewhat since oil price moved up.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary