Dollar index trading at 100.71 (+0.00%)

Strength meter (today so far) – Aussie -0.15%, Kiwi -0.46%, Loonie +0.06%

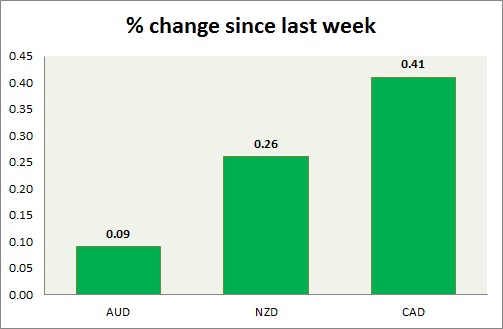

Strength meter (since last week) – Aussie +0.09%, Kiwi +0.26%, Loonie +0.41%

AUD/USD –

Trading at 0.749

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Range

Support –

- Long term – 0.71, Medium term – 0.73, Short term – 0.75

Resistance –

- Long term – 0.782, Medium term – 0.78, Short term – 0.78

Economic release today –

- In April report, Westpac consumer confidence declined by 0.7 percent.

Commentary –

- Weak metal prices weigh on Aussie, which is the worst performer of the week so far. Aussie might decline to 0.72 area once more to test support.

NZD/USD –

Trading at 0.692

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.733

Economic release today –

- Business PMI report will be published at 22:30 GMT.

- Food price index will be updated for March at 22:45 GMT.

Commentary –

- Kiwi is the worst performer of the day but still positive on the dollar this week.

USD/CAD –

Trading at 1.332

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.28, Medium term – 1.3, Short term – 1.3

Resistance –

- Long term – 1.38, Medium term – 1.365, Short term – 1.365

Economic release today –

- BoC will announce interest rate decision at 14:00 GMT, followed by the press conference at 15:15 GMT.

Commentary –

- Loonie is the best performer of the week so far as rising oil price on geopolitical tensions provides support. The focus is on BoC rate decision.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022