Dollar index trading at 97.15 (+0.56%)

Strength meter (today so far) - Aussie -0.55%, Kiwi -1.00%, Loonie -1.30%.

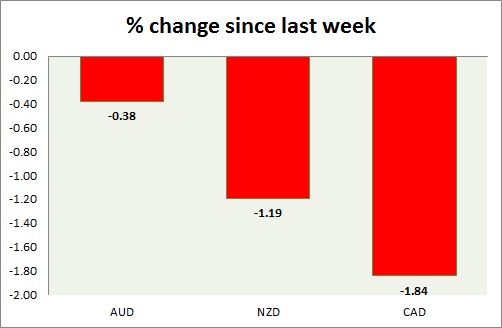

Strength meter (since last week) - Aussie -0.38%, Kiwi -1.19%, Loonie -1.84%.

AUD/USD -

Trading at 0.74

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.71-0.715

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.793-0.796

Economic release today -

- Westpac consumer sentiment dropped -3.2% in July.

- New motor vehicle sales rose 3.8% in June on monthly basis.

Commentary -

- Aussie is the better performer today, as Chinese economic optimism lifts Aussie. However, bigger trend remains bearish. Sell Aussie with stop around 0.785 and 0.825 to target 0.715, 0.70 and 0.65.

NZD/USD -

Trading at 0.663

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/sell resistance

Support -

- Long term - 0.653, Medium term - 0.65, Short term - 0.65

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.737-0.74, Immediate - 0.705

Economic release today -

- NIL

Commentary -

- Kiwi is treading water around crucial support of 0.65. Might test the level, over coming days. Outlook still remains bearish.

USD/CAD -

Trading at 1.29

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.17, Medium term - 1.1840-1.18, Short term - 1.217-1.213

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.28.(broken)

Economic release today -

- Bank of Canada (BOC) cut rates by 25 basis points today.

Commentary -

- Canadian dollar remains sell against dollar, the pair might reach as high as 1.38. BOC's rate cut pushed loonie lower against dollar today.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings