Dollar index trading at 99.17 (+0.34%)

Strength meter (today so far) – Aussie -0.67%, Kiwi -0.79%, Loonie -0.06%

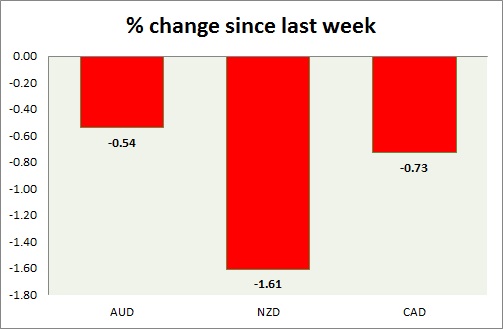

Strength meter (since last week) – Aussie -0.54%, Kiwi -1.61%, Loonie -0.73%

AUD/USD –

Trading at 0.753

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Range

Support –

- Long term – 0.71, Medium term – 0.73, Short term – 0.75

Resistance –

- Long term – 0.782, Medium term – 0.78, Short term – 0.78

Economic release today –

- Consumer price inflation grew 2.1 percent y/y in the first quarter of 2017.

- RBA trimmed mean CPI came at 1.9 percent y/y.

Commentary –

- Aussie declined below 0.75 area as the commodities weakened and due to fear of trade protectionism in the US. Aussie might decline to 0.72 area once more to test support.

NZD/USD –

Trading at 0.696

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.733

Economic release today –

- NIL

Commentary –

- President Trump’s dairy dispute with Canada has triggered a selloff in the New Zealand dollar. New Zealand is the biggest dairy exporter in the world.

USD/CAD –

Trading at 1.36

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.28, Medium term – 1.3, Short term – 1.3

Resistance –

- Long term – 1.38, Medium term – 1.365, Short term – 1.365

Economic release today –

- Retail sales declined by 0.6 percent in February.

Commentary –

- Loonie is a much better performer today but remains weak as the US imposes tariffs on lumber from Canada.