Dollar index trading at 96.38 (+0.31%)

Strength meter (today so far) - Aussie -0.01%, Kiwi -0.13%, Loonie -0.07%.

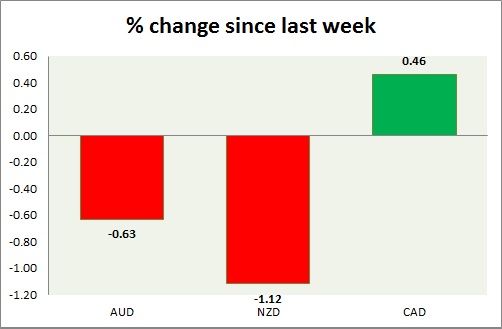

Strength meter (since last week) - Aussie -0.63%, Kiwi -1.12%, Loonie +0.46%.

AUD/USD -

Trading at 0.737

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.71-0.715

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.78, Immediate - 0.75

Economic release today -

- NIL

Commentary -

- Aussie remains stagnant below0.74 mark to end the week. Active call - Sell Aussie with stop around 0.785 and 0.825 to target 0.715, 0.70 and 0.65.

NZD/USD -

Trading at 0.655

Trend meter -

- Long term - Sell, Medium term - Range/sell, Short term - Range/sell

Support -

- Long term - 0.653, Medium term - 0.65, Short term - 0.65

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.737-0.74, Immediate - 0.705

Economic release today -

- NIL.

Commentary -

- Kiwi is the worst performer this week and likely to fall further.

USD/CAD -

Trading at 1.307

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.17, Medium term - 1.217, Short term - 1.265

Resistance -

- Long term - 1.32, Medium term - 1.315-1.32, Short term - 1.32

Economic release today -

- Manufacturing shipments rose by 1.2% in June.

Commentary -

- Canadian Dollar might rise against Dollar in the short term, if oil bounce back. Active call - Canadian dollar remains sell against dollar, the pair might reach as high as 1.38.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings