Dollar index trading at 95.99 (-0.48%)

Strength meter (today so far) - Aussie -0.09%, Kiwi +0.56%, Loonie +0.28%.

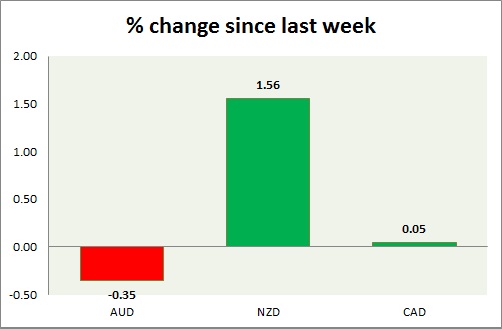

Strength meter (since last week) - Aussie -0.35%, Kiwi +1.56%, Loonie +0.05%.

AUD/USD -

Trading at 0.734

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.71-0.715

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.78, Immediate - 0.75

Economic release today -

- NIL

Commentary -

- Aussie remains sell due to tensions in China. Active call - Sell Aussie with stop around 0.785 and 0.825 to target 0.715, 0.70 and 0.65.

NZD/USD -

Trading at 0.663

Trend meter -

- Long term - Sell, Medium term - Range/sell, Short term - Range

Support -

- Long term - 0.653, Medium term - 0.65, Short term - 0.65

Resistance -

- Long term - 0.78, Medium term - 0.75, Short term - 0.70, Immediate - 0.68

Economic release today -

- NIL

Commentary -

- Kiwi is the best performer and rose further today as FOMC was more dovish than expected.

USD/CAD -

Trading at 1.309

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.17, Medium term - 1.217, Short term - 1.265

Resistance -

- Long term - 1.32, Medium term - 1.315-1.32, Short term - 1.32

Economic release today -

- Whole sales rose by 1.3% in June.

Commentary -

- Weaker oil price creating headwinds for loonie along with slowdown in manufacturing. Loonie is likely to slide towards 1.38 against Dollar, as oil prices selloff continues.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?