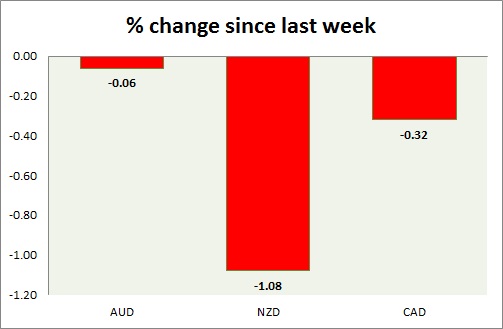

Commodity pairs (AUD, NZD, & CAD) did very well since last night as the majors faltered over the rate outlook. A chart and table is attached for explanation.

- Aussie is doing well against the dollar but failed to break above the resistance on positive GDP. Australian GDP grew 0.5% in the fourth quarter and 2.5% YoY. Aussie is currently trading at 0.784, up 0.3 percent for the day. Immediate Support lies at 0.767 & Resistance 0.792.

- Kiwi looks like will soon break above the resistance, testing it throughout the day. It could see significant position built up once the level is broken. No major event risk from New Zealand for the week ahead and the pair might continue its bullish bias. Pair is currently trading at 0.76. Immediate Support lies at 0.742 & Resistance 0.762.

- Canadian dollar is trading sideways for the day in a narrow range with low volume as the market is awaiting the policy decision from BOC later at 15:00 GMT. Canadian dollar might join its commodity peers in gaining ground if the policy outlook remains neutral. Currently trading at 1.251. Immediate Support lies at 1.235 & Resistance 1.272.

|

AUD |

0.58% |

|

NZD |

-0.50% |

|

CAD |

-0.18% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary