Dollar index trading at 94.92 (-0.88%)

Strength meter (today so far) - Aussie +0.04%, Kiwi +1.22%, Loonie -0.70%.

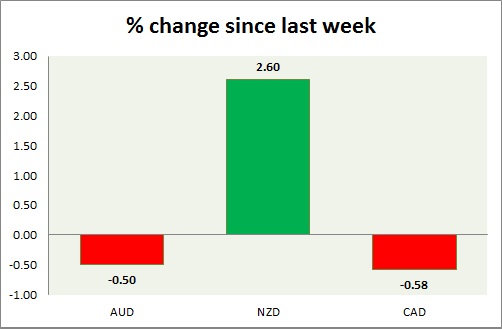

Strength meter (since last week) - Aussie -0.50%, Kiwi +2.60%, Loonie -0.58%.

AUD/USD -

Trading at 0.734

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.71-0.715

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.78, Immediate - 0.75

Economic release today -

- NIL

Commentary -

- Aussie is trading in small range below 0.75 resistance area. Active call - Sell Aussie with stop around 0.785 and 0.825 to target 0.715, 0.70 and 0.65.

NZD/USD -

Trading at 0.663

Trend meter -

- Long term - Sell, Medium term - Range/sell, Short term - Range/buy

Support -

- Long term - 0.653, Medium term - 0.65, Short term - 0.65

Resistance -

- Long term - 0.78, Medium term - 0.75, Short term - 0.70, Immediate - 0.68

Economic release today -

- NIL

Commentary -

- Kiwi is the best performer and rose further today as dollar weakened across board. Active call - Buy Kiwi with target around 0.692 and stop around 0.65

USD/CAD -

Trading at 1.309

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.17, Medium term - 1.217, Short term - 1.265

Resistance -

- Long term - 1.32, Medium term - 1.315-1.32, Short term - 1.32

Economic release today -

- Consumer price index rose by 1.3% in July, slower than anticipated with core prices failing to grow.

Commentary -

- Weaker oil price creating headwinds for loonie making it the worst performer this week. Weaker than projected inflation raised speculation of further rate cut by Ban of Canada. Loonie is likely to slide towards 1.38 against Dollar, as oil prices selloff continues.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand